Sustainability

AXA EssentiALL: Inclusive insurance

Ensuring underserved customers around the world gain access to protection for their families, businesses and communities.

Protecting people and businesses, and what matters to them, is key for social cohesion and human progress. As a global leading insurer, it is our duty and desire to contribute to closing the global protection gap. Indeed, 70% of the emerging world and 25% of European market populations are un(der) or ill-insured and do not have equal access to insurance products and services, or if they do, it is not always fitted to their needs..

AXA launched in 2016 its inclusive insurance business unit, AXA Emerging Customers, precisely to address this significant protection gap affecting the low- to middle-income households and small businesses in emerging markets. It has now extended its geographical scope to its European markets, to address the protection needs of their low-income households and small businesses, who are facing higher degrees of uncertainty, decreasing purchasing power and making arbitrations, including with regards to insurance. This geographical extension had led to a renaming of the business in order to align with the global nature of the scope. AXA Emerging Customers has been renamed AXA EssentiALLin order to better reflect its universal nature, its new global geographical scope and its objectives: to address the essence of insurance, cover our clients’ essential needs and contribute to better protecting if not all, at least as many clients as possible.

Through AXA EssentiALL, inclusive insurance is at the heart of AXA’s new #UnlockTheFuture 2024-2026 strategic plan, with an ambition to protect over 20 million customers around the world by 2026.

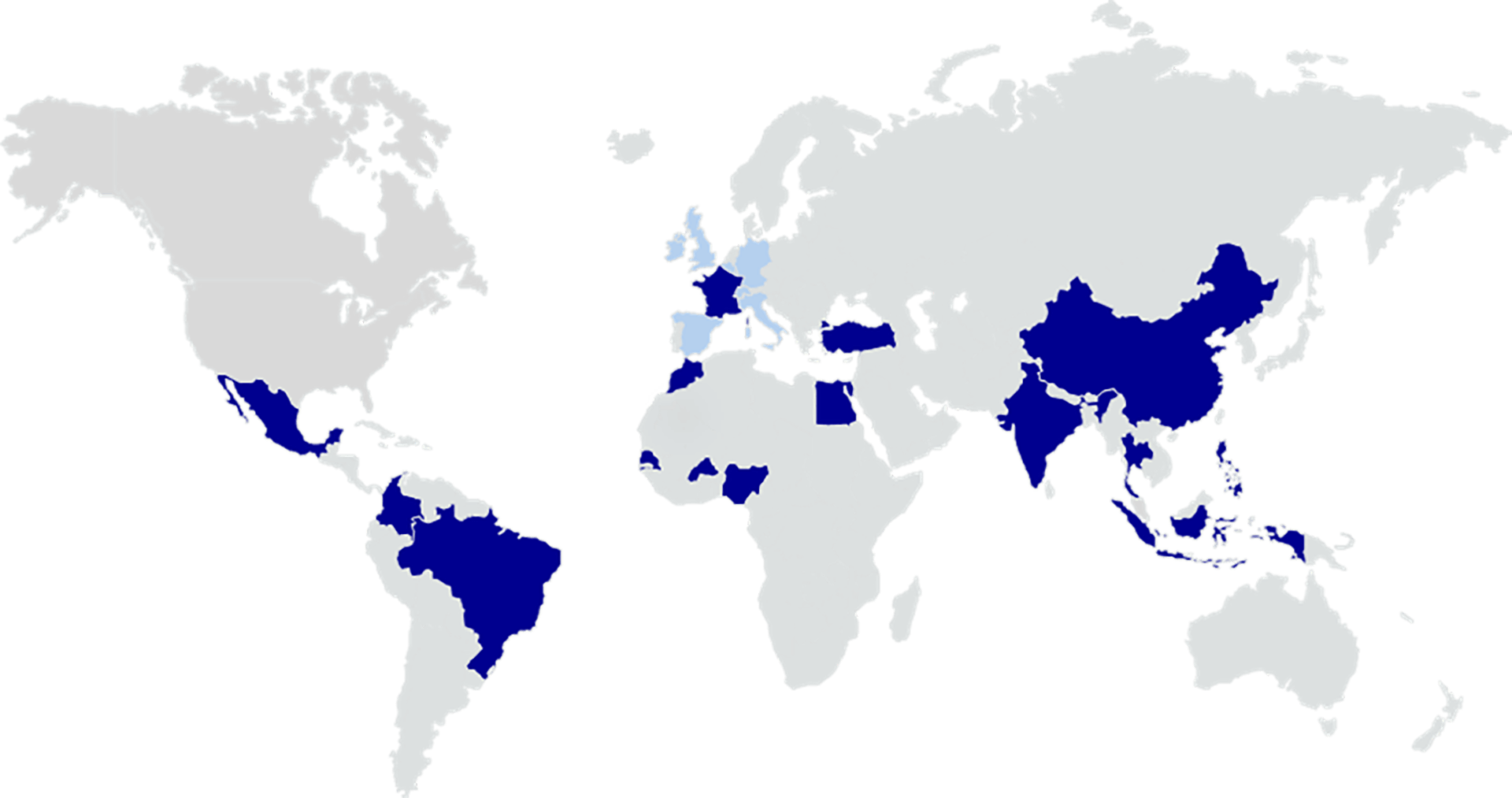

Countries in dark blue show the 14 markets covered for 2023 (Brazil, China, Colombia, Egypt, France, Indonesia, India, Mexico, Morocco, Nigeria, The Philippines, Thailand, Türkiye, and Senegal)

Countries in light blue show 7 European markets that are part of the expansion starting 2024: Italy, Belgium, Germany, Spain, Ireland, Great Britain, Switzerland

Key figures for 2023

Ambition for 2026: Over 20 million customers

Garance Wattez-Richard

CEO of AXA EssentiALL

In line with AXA’s ambition to be a universal brand that contributes to Human progress, AXA EssentiALL aims to enable vulnerable populations in the world to be more resilient thanks to protection solutions relevant to their needs. Universal protection is the key to a fair and inclusive transition.

Reinventing insurance: An inclusive business model in practice

Adapting insurance to the needs of emerging customers involves reinventing our business model to overcome barriers of cost, access, understanding, and trust. AXA EssentiALL adapts products and distribution strategies to our target segment to ensure that inclusive insurance products are:

Affordable: AXA’s inclusive insurance products focus on clients’ essential needs, taking out unnecessary bells and whistles while introducing flexible payment facilities compatible with customers’ cash flows.

Accessible: AXA distributes its inclusive insurance products through channels which are trusted by low-to-middle income customers and micro-businesses. These include microfinance institutions, small banks, farmer cooperatives, mobile phone network operators, digital payment companies, retailers but also public private partnerships.

Attractive: Inclusive Insurance products are designed to be relevant to these customers’ needs such as for example simple and transparent contractual documents. The customer journey all the way to claims is adapted to the segment’s preferences – whether physical, digital or both – offering simplicity and convenience.

AXA’s inclusive insurance business at a glance

Given the wide range of risks faced by low to middle-income customers, AXA EssentiALL designs insurance solutions that protect our customers’ lives and health, the continuation of businesses, and their assets, but also as much as possible extending these protections to their families and dependents across a wide range of products.

Of policies in force

- Protection & Health

- Property & Casualty

- Bundled

- Protecting our customers and their families (Protection and Health - 78% of policies inforce)

a. Life insurance products protect the family livelihood in case of death and/or disability;

b. Health insurance aims at limiting out-of-pocket expenses and compensating the loss of income derived from unexpected health-related conditions. In several markets, we are providing additional services that helps customers manage their everyday health needs. For example, since 2021, AXA has developed a protection solution together with Banco Mundo Mujer (BMM) in Colombia to protect nearly 600,000 mSMEs mainly run by women. The insurance protects them in the event of accidental death, disability, or certain critical illnesses, as well as telephone medical assistance for customers with a BMM consumer loan. AXA EssentiALL and BMM work together to continue promoting insurance as an instrument for financial inclusion in the country, which is why voluntary protection solutions are also being offered as part of this partnership, such as protected cash withdrawal or life protection for the co-debtors. - Protecting the critical productive assets of our clients, such as shops, cars, motorbikes, stock and agriculture production, to sustain family livelihood (Property & casualty products) - 14% of policies in-force

Property & Casualty products are extremely important to secure customers’ main source of income and sustain their livelihoods. It helps business owners with emergency cash if business-related assets are damaged due to fire, natural disasters, and other incidents.

For example, since 2022, AXA France partners with ADIE, the leading microcredit association in the country, to distribute 2 simplified offers specifically tailored to meet the needs of microentrepreneurs. - Developing tailored bundles of appropriate products to increase accessibility, affordability and adaptability for clients (Bundled products) - 8% of policies in-force

Based on customers’ needs, AXA designs solutions that protect customers against a combination of risks, for example, an insurance product that will support a small business owner and her family to repay her business loan in the event of death, but will also protect the family business against fire and theft (Morocco).

AXA has set up the project Insurance Net for Smallholder farmers (INES) in Burkina Faso with L’Oréal. It involves insuring shea nut collectors in rural areas of Burkina Faso against droughts, but also health risks such as malaria and accidents. Cooperatives of shea producers distribute the cover to their members, who are 100% women. AXA Climate and AXA EssentiALL respectively reinsure the climate product and coordinates the project.

As a business with social impact, AXA EssentiALL aims to provide affordable, accessible, and attractive products to underserved communities in our markets in order to ensure their financial health and sustained growth even in the face of unexpected events.

AXA EssentiALL’s vision is to build a financially viable business, with a relevant positive impact on customers. This is why we measure the customer centricity of our products (e.g., are we simplifying terms and conditions, have we made the claims process easier) and collect social indicators as much as possible (e.g., % of women insured).

In complement, we work with partners to conduct impact measurement research. By working with these partners locally, we reach out to customers directly to understand if our solutions are supporting household finances in the face of unexpected events and fostering an insurance culture. This evaluation helps to inform further product improvements and developments and is a first step in an internal approach to measuring the effects that insurance can have within communities.

Contributing to a Fair and Inclusive transition

Low-income populations face increasing risks due to climate change and growing financial needs to support climate adaptation. For example, climate change can lead to farmers losing their crops, fishermen being injured during extreme weather events, individuals having to work in extreme heat all of which results in increasing revenue loss. It is estimated that more than 100 million people will be pushed into extreme poverty by 2030 because of climate change, while more than 200 million people could be displaced by more frequent and severe climate disasters.

Jean Jouzel

Previous Vice-President of the GIEC (Group 1)

One of the first consequences of climate change is increasing inequalities globally.

AXA’s vision is to support the transition to a low-carbon and less resource-intensive economy that also fosters inclusion and resilience for climate adaptation, including for low- and middle-income populations. Insurance, by helping individuals and businesses cope with shocks, is an important tool to creating resilience and is a key part of the solution for climate adaptation leading to a Fair and Inclusive transition globally.

In Indonesia for example, the livelihood of smallholder farmers is highly impacted by recurring extreme events like floods and droughts, as well as long-term changes in rainfall patterns and increasing temperatures linked to climate change. Since 2022, AXA has been working in partnership with the InsuResilience Solutions Fund, AXA Climate and two Indonesian agribusiness partners to test a parametric insurance protecting corn and rice farmers in several Indonesian provinces. The product aims to give smallholder farmers rapid access to funding in the case of severe drought or excessive rainfall, without the need for an individual field-level assessment.

A strong leadership voice

Contributing to achieve sustainable development through inclusive insurance requires continuous cooperation between a number of actors, public and/or private, to find and offer new ways to manage risks. AXA EssentiALL partners with organizations and consortia that share the same vision and values.

A few examples of partnerships

AXA EssentiALL is active within the inclusion space with partners such as the Insurance Development Forum (IDF) and Microinsurance Network (MiN). AXA also advances the finsancial inclusion agenda by funding the Landscape of Microinsurance, an annual study run across the industry. In China, AXA EssentiALL collaborated with the Chinese Academy of Financial Inclusion (CAFI) in launching a research partnership to understand the financial lives of low-income households. AXA EssentiALL has also partnered with the Universal Postal Union (UPU) to advance inclusive insurance distribution through postal networks.

Governance

AXA EssentiALL, as the dedicated business unit in charge of executing AXA’s commitment to financial inclusion, reports directly to the Deputy CEO of AXA. Its performance is overseen by an Inclusive Insurance Steering Committee set up with key AXA Management Committee members across all AXA geographies (Emerging markets and European markets, including France). The Compensation, Governance & Sustainability Committee reviews, at least once a year, the Group’s sustainability strategy (including AXA EssentiALL’s ambition and performance) as well as material sustainability-related commitments disclosed publicly and reports to the Board of Directors in this regard.

On top of these efforts, AXA EssentiALL is committed to AXA's strong Code of Ethics to ensure customers are always treated fairly and professionally, limiting aggressive sales techniques and promoting responsible practices. AXA’s code of conduct includes for example a clause committing to never providing false information to clients, business partners, and competitors.

Contacts

AXA EssentiALL

Contact Email